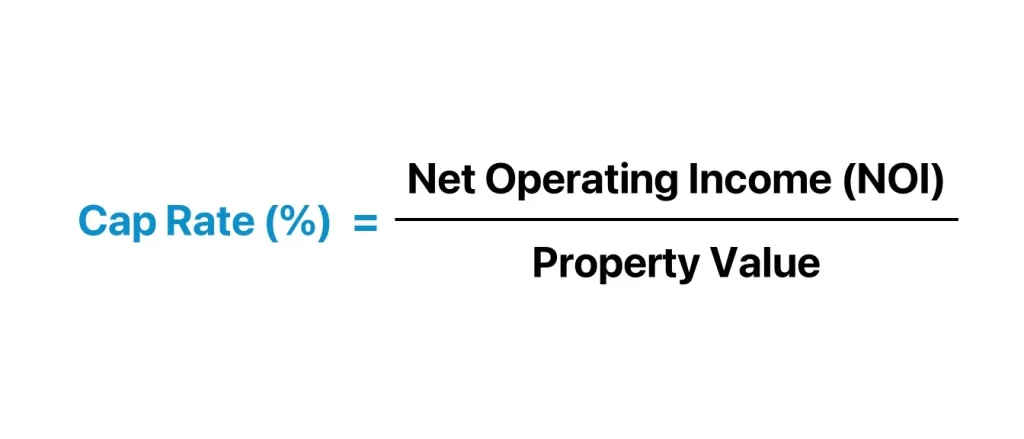

Capitalization rate (cap rate) is one of the key metrics you as a real estate investor can use to evaluate potential apartment investments. The cap rate gives you a snapshot of the potential return you can expect from buying an income-producing property like an apartment building. However, beyond the standard formula (Net Operating Income/Property Value), lies a complex world of nuances and hidden factors that can significantly impact your investment decisions.

Understanding how to calculate and use cap rates can help you assess the profitability of a prospective multifamily investment.

So, let’s quickly discuss the capitalization rate, how you calculate it, and how it can inform your apartment investment strategy.

The capitalization rate (cap rate) is the ratio between an investment property’s net operating income (NOI) and its current market value. Simply, it tells you the rate of return you can expect to receive based on the property’s income and purchase price. For apartment buildings and other income properties, the NOI represents the annual rental income minus expenses like property taxes, insurance, maintenance, and vacancies.

You calculate the cap rate by dividing the NOI by the property’s price. For example, if a property has an NOI of $100,000 and a market value of $1 million, the cap rate would be 10% ($100,000/$1,000,000 = 0.10 or 10%). The higher the cap rate, the better the potential return for you.

The capitalization rate equation seems simple at first glance. But don’t let that mislead you. There are nuances hidden within the formula that you must understand.

a) Net Operating Income (NOI):

Calculating NOI is the first step. This is your gross revenue minus operating expenses. Be sure to exclude financing costs and depreciation. Focus only on the property’s true annual costs.

Next, you must pinpoint the optimal vacancy rate allowance. Anticipating vacancies requires a keen understanding of market conditions. Set this figure too high and you underestimate the potential. Too low, and your pro forma loses accuracy. Tread carefully here.

b) Property Value:

Deriving the appropriate valuation also requires your sharp eye. Relying solely on the advertised price misrepresents the asset’s true market value. It would be best if you considered factors like seller motivations and financing terms. Are overpricing masking issues undisclosed? Dig deeper through comps analysis to reveal the property’s worth.

c) Hidden Adjustments:

Now, we come to cap rate adjustments. Making tweaks allows you to transform a basic metric into an advanced decision-making tool. Customize the cap rate to reflect unique property attributes. Does it have upcoming rehab needs or deleterious zoning? Adjust accordingly. Also, consider your own investing goals and risk tolerance. The wise investor tailors the formula to fit their strategy.

Here are the steps you take to calculate a property’s capitalization rate:

For example, if a property has $300,000 in effective gross income, $150,000 in operating expenses, and a market value of $2 million, you would calculate:

NOI = $300,000 – $150,000 = $150,000

Cap Rate = $150,000/$2,000,000 = 0.075 or 7.5%

Capitalization rates vary greatly depending on the type of asset and location. By analyzing cap rate differences, you gain insight into strategic investing.

Value-Add vs. Core Investments:

Value-added properties generally have higher cap rates than core assets. This compensates for their increased risk and rehab costs. For you, higher potential returns come with more work. Alternatively, core properties in prime areas offer lower cap rates. What you gain in stability, you lose in upside. Compare deals across the spectrum to balance returns and risk.

Geographical Variations:

The location also impacts cap rates. You will find the lowest cap rates in core markets like New York and San Francisco. Other major metros also trade at premium prices. Secondary and tertiary markets present higher cap rates by comparison. Be aware, that increased returns may come with greater vacancies and management challenges.

Asset Class Specificity:

Cap rates also differ significantly across asset classes. Multifamily properties generally trade from 4% to 8%. Meanwhile, office buildings commonly transact from 6% to 10%. And retail cap rates range from 7% to 12% based on factors like tenant mix. Consider benchmarks for each property type as you evaluate deals.

Some key ways capitalization rates inform your apartment investment strategy include:

Understanding and properly using capitalization rates will help you assess potential returns and risks for apartment building investment. Moreso, you should conduct thorough due diligence and work closely with real estate professionals when evaluating cap rates.

As an apartment investor, the capitalization rate allows you to assess potential returns by dividing a property’s net operating income by its market value. A higher cap rate signals a better return but also greater risk. To make smart investment decisions, take time to properly calculate cap rates across different properties, markets, and periods. This analysis will inform your multifamily strategy and criteria for profitable deals.

More Read: