While many believe wealth-building is confined to selecting the right stocks or bonds, the ultra-rich diversify into real estate for faster prosperity. Real estate, offering asset leverage, forced appreciation, and steady cash flow, has quietly created more millionaires than hyped shares and securities. This is among the distinction between real estate vs stocks and bonds.

This article will outline the differences between real estate, stocks, and bonds, emphasizing when real estate is superior and how combining them can speed up financial freedom. The wealthy use a balanced approach, not relying on a single asset.

Real estate investing, a practice dating back to cave drawings, has gained popularity recently due to increased property values. The development of property rights marked a significant milestone, making real estate a common income source throughout history. Despite the recent boom, the concept of using property as an investment has ancient origins.

While stocks and bonds have advantages, real estate offers greater cash flow, tax benefits, and control. We are going to examine these differences shortly so you will understand why, depending on your goals, you should consider real estate against stocks & bonds, and vice versa.

Real estate investing yields returns through appreciation and rental income. Appreciation, the increase in property value over time due to factors like market demand, is realized upon sale and can be taxed as capital gains. Rental income, the money received from tenants, provides a steady cash flow, covering expenses and generating profits. Both contribute to a property’s ROI and involve different risks and rewards, aligning with various investment goals and strategies.

Historically in the last 15 years, stocks have yielded higher returns than real estate, with the S&P 500 index averaging around 10% annualized return over long periods, compared to real estate’s typical 4-8% range. However, these figures can vary based on time, real estate type, and risk and volatility levels. Stocks and real estate differ in tax implications, liquidity, and diversification benefits. Thus, investors should consider their goals, preferences, and risk tolerance when choosing between these asset classes.

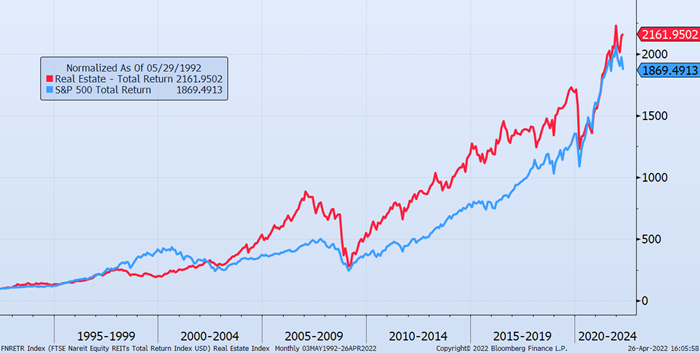

This charts below show the value of $100 invested in real estate (red) and the stock market (blue).

Over the last 30 years, real estate won, but not by a significant margin.

Bonds pay fixed interest regularly, typically semi-annually or annually, until maturity, when the principal is returned. These interest payments, also known as coupons, are a source of income from bonds. This coupon rate is the annual interest rate that the bond pays, expressed as a percentage of the bond’s face value.

Investors prefer real estate for its consistent cash flow through rental income, covering costs and generating profits. Stocks and bonds also provide cash flow through dividends and interest, but these are variable and not guaranteed. They’re also less frequent, typically paid quarterly or annually. Hence, real estate offers a more predictable cash flow compared to stocks and bonds.

Real estate investing can offer various tax advantages that can reduce your taxable income and increase your returns. Here are some of the main tax benefits of real estate:

Real estate investors can deduct property ownership and operation costs, including mortgage interest, taxes, insurance, maintenance, and utilities, from their income. They can also deduct property depreciation, the value loss from wear and tear. Depreciation is a non-cash expense that can lower your taxable income without affecting your cash flow.

Real estate investors can use a strategy called a 1031 exchange to defer paying capital gains taxes when they sell a property. A 1031 exchange allows you to sell a property and reinvest the proceeds into another property of similar or greater value within a certain time frame. Thus, you can defer paying taxes on the gain until you sell the new property, or indefinitely if you keep exchanging properties.

Real estate income, typically seen as passive income, isn’t subject to self-employment or additional Medicare taxes. It’s taxed at lower rates than active income like wages. In 2023, the top tax rate for ordinary income is 39.6%, while for qualified dividends and long-term capital gains, it’s 20%.

Stocks and bonds generate income via dividends and interest, respectively, taxed as ordinary income unless qualified or tax-exempt. They can appreciate, leading to lower-taxed capital gains if held over a year. Real estate offers more tax benefits but is more complex. Consult a tax professional before investing due to potential tax law changes.

Leverage is the use of borrowed money to increase the potential return on an investment. It comes with risks and costs, such as interest payments, loan fees, and the possibility of losing more than the initial investment. Here are some of the main leverage benefits of real estate:

Real estate investors can finance over 80% of a property’s purchase price with mortgages, allowing them to buy a $100,000 property for just $20,000. The rental income can be used to pay off the mortgage, enabling control of a larger asset than its initial investment and benefiting from its appreciation and cash flow.

Leverage accelerates equity and cash flow growth compared to all-cash investments. Equity, the property value minus the mortgage, increases as the mortgage is paid off and the property appreciates. As rental income grows over time, cash flow increases, enhancing the ROI and the investor’s wealth.

Stock investors can use leverage via margin investing, and borrowing from a broker to buy more stocks. For instance, using $10,000 of their money and $10,000 borrowed, they can buy $20,000 worth of stocks. A 10% increase allows selling for $22,000, yielding a $2,000 profit minus interest and fees, doubling the return. However, a 10% decrease can lead to a $2,000 loss, doubling the loss.

Real estate investing offers more control over your property than stocks or bonds. As a landlord, you decide on rent, maintenance, renovations, and marketing, choose tenants, negotiate lease terms, and manage the property.

Conversely, as a stock or bond investor, you own a small part of a company or debt instrument with limited influence over its management and performance. You can’t control company spending, offerings, or competition handling, and rely on market forces and other investors for investment value. You have minimal control over portfolio risks and returns.

Liquidity, the ease of converting assets into cash without significant value loss, is a key factor in comparing real estate and stocks/bonds investing. Real estate is generally less liquid than securities, but investing in Real Estate Investment Trusts (REITs) can offer liquidity. REITs own income-producing properties, trade on stock exchanges, and pay dividends, providing steady income.

Direct property ownership, however, may involve challenges in quick buying or selling. It requires finding a buyer or seller, price negotiation, inspections, financing, and legal paperwork, which can take weeks or months and incur various expenses. Thus, real estate investing demands more patience and planning than stocks/bonds investing.

You may wonder whether you should invest in real estate or stocks and bonds. However, there is no clear answer, as both have their pros and cons. The best option for you depends on your goals, risk tolerance, time horizon, and personal preferences. If you want stable cash flow and tax benefits, you may prefer real estate investing. But if you want higher growth potential and diversification, you may opt for the stock market. Altogether, you have to weigh the pros and cons of each option and decide what works best for you.

More Read: